Table of Contents

- 401k Contribution Limits 2024 Calculator Roth - Irene Leoline

- What Are Roth 401(k) Contribution Limits? | The Motley Fool

- How Much Should I Contribute to My 401(k)?

- Catch-Up Contributions Into a Roth 401(k) Isn't a Bad Idea | Kiplinger

- What Are 2014 and 2015 Roth 401k Contribution Limits? - Money Nation

- Maxing Out 401(k) & Roth IRA Plans | Limits, Benefits & What Is Next

- Max 401k Employer Contribution 2025 - Lillian Wallace

- Max 401k Employer Contribution 2025 - Lillian Wallace

- 401(k) Contribution Limits 2021

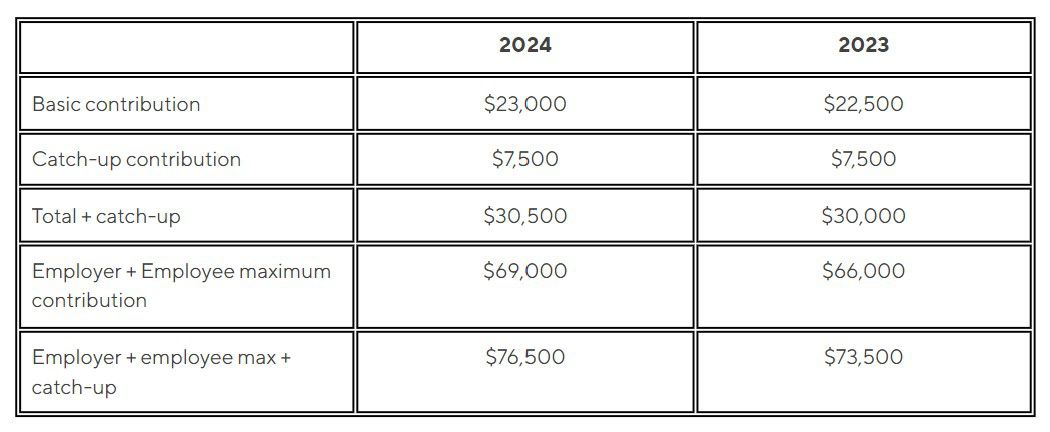

- 401(K) contribution limits are set to rise in 2024 - here's how to plan ...

Background: The SECURE Act 2.0

_and_Roth_IRA_Contributions_Benefits.png?width=1920&name=Maxing_out_401(k)_and_Roth_IRA_Contributions_Benefits.png)

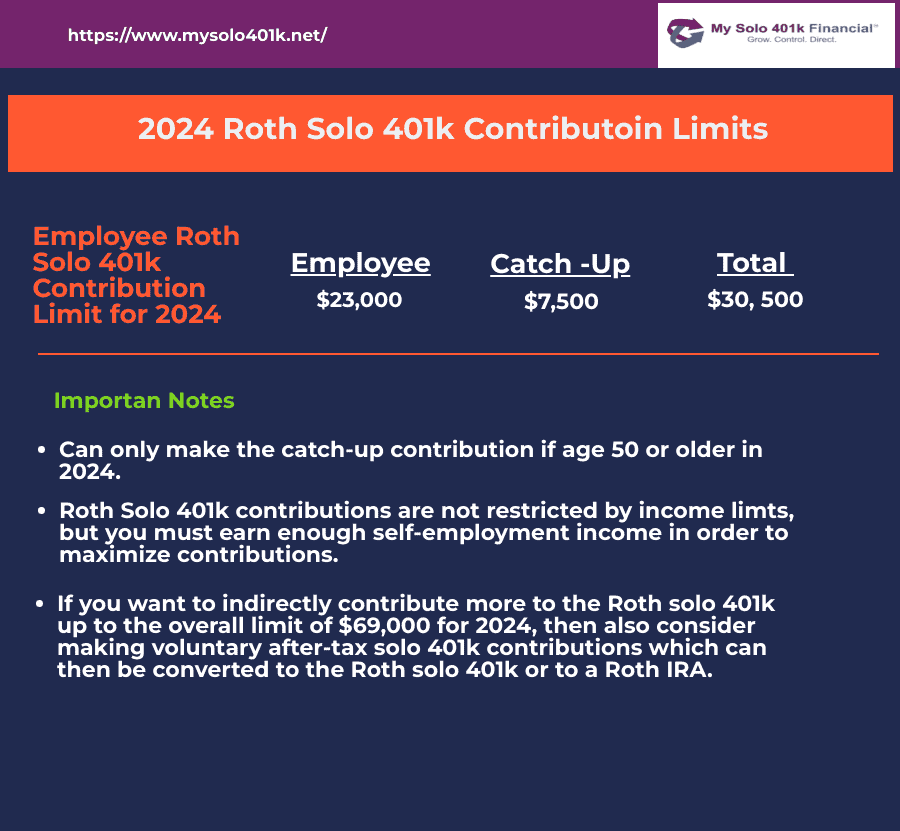

Key Details: Mandatory Roth 401(k) Catch-up Contributions

Implications for Employees and Employers

The mandatory Roth 401(k) catch-up contributions will have significant implications for both employees and employers: Employees: High-income employees will need to consider the tax implications of making Roth catch-up contributions. While these contributions will not reduce their taxable income, they will provide tax-free growth and distributions in retirement. Employers: Plan sponsors must ensure compliance with the new regulation, which may involve updating plan documents, communicating changes to participants, and adjusting payroll processes. The mandatory Roth 401(k) catch-up contributions, set to take effect in January 2025, mark an important change in retirement savings regulations. As the IRS confirms the details of this provision, employees and employers must prepare for the implications. By understanding the key aspects of this change, individuals can make informed decisions about their retirement savings, and plan sponsors can ensure compliance with the new rules. As the retirement landscape continues to evolve, staying informed about these changes is crucial for securing a stable financial future.For more information on the mandatory Roth 401(k) catch-up contributions and how they may impact your retirement savings, consult with a financial advisor or plan sponsor. Stay ahead of the curve and make the most of your retirement planning opportunities.